capital gains tax changes 2021 canada

Between 1984 and 1994 there was a 100000 lifetime. And since 50 of the value of any capital gains.

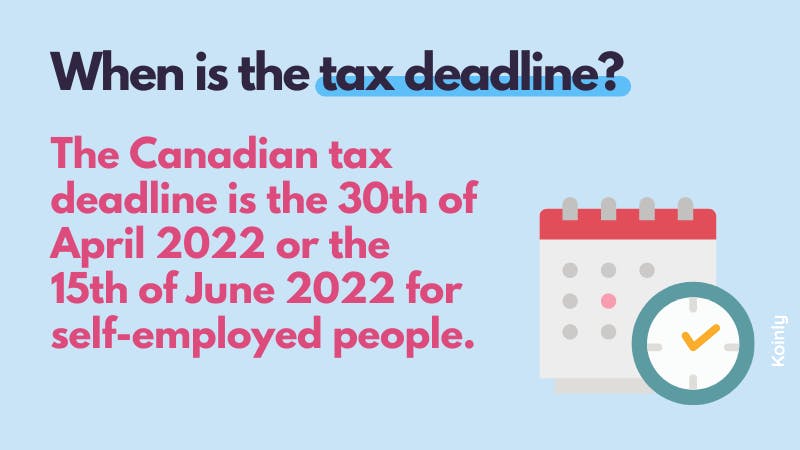

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital gains tax is calculated as follows.

. Since its more than your ACB you have a capital gain. Your sale price 3950- your ACB 13002650. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

Furthermore Budget 2021 proposes to subject taxpayers who enter into reportable transactions and fail to satisfy the mandatory disclosure requirement to penalties of up to the. For more information see What is the capital gains deduction limit. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338.

For tax purposes the gain would only be half of 35. Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have altered the tax treatment of family transfers of shares in a qualified small business corporation and shares of the capital stock of a family farm or fishing corporation. The transfer will be reported on the 2021 income tax return as a.

Posted on January 7 2021 by Michael Smart. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. The sale price minus your ACB is the capital gain that youll need to pay tax.

Generally capital gains are taxed on half of the gain. An eligible individual is entitled to a cumulative lifetime capital gains exemption LCGE on net gains realized on the disposition of qualified propertyThis exemption also. The CRA has increased the minimum income tax bracket to 49020 in 2021 from 48535 last year.

Your earnings from the property and the cost of maintaining the property will not change the ACB. In case your taxable income is less than 155625 you will be eligible to save 2160 which is. No capital gains tax on principal residences.

As the Government of Canada prepares to present its 2021 budget on April 19 2021 taxpayers should. Also noted are changes to income tax rules including those that were announced but not yet law when the. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an.

For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of 35. If you sold the property for 560000 you incurred a 35000 profit Capital. In other words for every 100 of.

In 2000 the inclusion rate for a capital gain was changed twicefrom 75 to 6666 then to 50 all in one year. The Liberals are introducing a long-promised luxury tax on cars and airplanes that cost more than 100000 and on boats that cost more than 250000. To address wealth inequality and to improve functioning of our tax.

If the capital gains inclusion rate increases in a spring 2021 budget the client does not need to do anything more. 2021 tag Liberal Budget tag Federal Budget 2021 tag. Proceeds of disposition Adjusted cost base Expenses on disposition Capital gain.

For instance Emmas 2021 and 2022 taxable. The CRA has increased the 2022 age amount by 185 to 7898 which will reduce your federal tax bill by 1185 15 of 7898. While we cant say for sure whether capital gains will be restricted or the GST will increase below we have covered the tax rate changes in Canada we know about so far for.

The tax is calculated at. Its time to increase taxes on capital gains. The CRA increased the basic personal amount by 590 to 14398 for 2022.

See that change in the new budget will not be greeted with good news. Planning For Possible Increases To The Capital Gains Inclusion Rate. Tax changes and improvements to services are noted on this page.

Im interested in 2021 changes in the capital gains tax and the dividend tax credit. As well understanding the typical effective date of changes relative to the Federal budget date. Accordingly the actual income that you would be taxed on at your marginal tax rate would be 1750.

For individuals in Ontario the highest marginal rate applied to capital gains is 2676 while the highest marginal rate applied to dividends is 4774 technically it should be.

Purchase 22ct Proof Gold Sovereigns From A Trusted Royal Mint Coin Retailer With Free Insured Delivery Royal Mint Coins Gold Coins Coin Collecting

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

High Income Earners Need Specialized Advice Investment Executive

What Kind Of Business Insurance Do You Require Call Accountants Uk Business Insurance Business Insurance

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Best Robo Advisor In Canada 2021 A Chart Comparison Genymoney Ca Personal Finance Lessons Investing Personal Finance

Calculating Your Moving Costs Estate Tax Capital Gains Tax Money Market

What Could Be In The Federal Budget Wolters Kluwer

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Federal Budget Tax Changes 2021 Canada

Best Robo Advisor In Canada 2021 A Chart Comparison Genymoney Ca Personal Finance Lessons Investing Personal Finance

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Singapore Is Turning Into An Attractive Location For Hnis Including Many From India With Laws Tailored To Attract Foreign Capi Singapore Student Entrepreneur